Consultant Wood Mackenzie (WoodMac) provided some considerations for the new year for iron ore and steel.

The company claims that the global iron ore industry is starting the new year in "surprisingly good shape." Prices are "holding on comfortably," despite all the rhetoric of a "hard landing" in China and escalating trade tensions, not to mention declining profit margins in steel production.

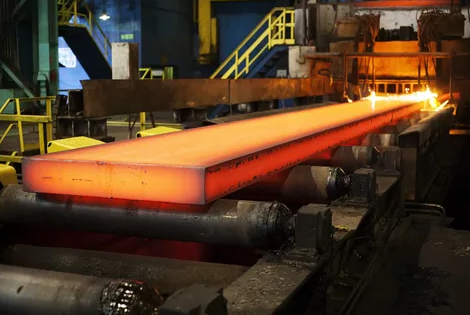

Iron ore prices are comfortably above $ 70 /t CFR, with little evidence of margin compression, according to WoodMac. The company's 2019 baseline forecast suggests that the ongoing restructuring of the Chinese steel and iron ore industry in response to increasingly stringent environmental controls will continue to support demand for iron ore supplied by sea. However, compliance is costly, WoodMac says, especially for its own mines in China, some of which will have to go underground, which means higher operating and capital costs.

WoodMac claims India could be the big deal in 2019. “We believe that the rise in Indian imports in 2018 was the start of a long-term structural trend, not a one-off leap forward. With the growth of China and the growth of India, a global maritime trade dynamics of at least 30 million tons should be achieved. This year, iron ore prices with 62% Fe fractions are being maintained at US $ 65-70 per tonne CFR, "the report says.

However, given the high level of economic and geopolitical risk around the world, problems will arise along the way.

On the steel side, WoodMac believes 2019 is shaping up to be a year of recalculation and reset of expectations. The steel industry has enjoyed stellar success since the second half of 2017, WoodMac said, but steel prices began to fall in November 2018, shrinking the steelmaker's brand to uncomfortable levels.

Regarding the demand for Chinese steel, WoodMac asks: Is there another rabbit in this hat? The company argues that “the policy sophistication needed to balance the Chinese economy (and support steel demand) will be increasingly challenged. It is alleged that Chinese leaders have so far prevented a "hard landing" in construction. "Incentive measures indicate a repeat of this feat, but building incentives are becoming more difficult and consumption of metal-intensive goods is limited."

In terms of trade wars, while demand grew, chambers of commerce provided additional price support to US steelmakers. As demand growth slows in 2019, will chambers of commerce bring

Subscribe to news

Metallurgy news

- 26 December 2025

18:00 EEC launches AD shelf life verification for seamless OCTG pipes from China 17:00 Japan's steel exports decreased by 3.8 percent in January-November 2025 17:00 Global Toyota car production Increased by 4.9 percent in January-November 2025 16:00 Turkey's base metals production capacity utilization in December 2025 from November 15:00 Turkey's construction sector confidence fell 0.5 percent in December 2025 compared to November 15:00 EU import quotas for the fourth quarter are exhausted as the end of the year approaches 15:00 China to strengthen control over new copper and alumina production projects 14:00 Japan's industrial production fell 2.6 percent in November 2025 compared to October.

Publications

26.12 Keratin for hair care restoration and protection 25.12 Diode lasers from Alvi Prague 25.12 Services of the exporter of Budivelny Smith 24.12 old furniture - how to dispose of it correctly 24.12 The computer does not start, beeps or shows a black screen: diagnostics by sounds and what to fix