In August, prices for thermal coal in Asia showed the longest increase in almost 2 years, but this momentum faded as domestic prices in China stabilized amid easing safety checks at mines, lower demand in the summer and increased hydroelectric power generation.

Prices for all grades of coal rose during August as part of an off-season trend supported by active purchases from China, the price advantage of domestic coal and expectations of restrictions on domestic supplies amid inspections of mines.

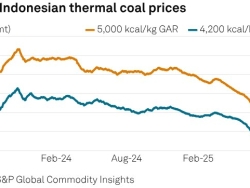

According to Platts estimates, the price of the most liquid grade of coal, Kalimantan, with a calorific value of 4,200 kcal/kg, rose consistently from August 1 to August 22, while the price of Kalimantan, with a calorific value of 5,000 kcal/kg, rose for 7 consecutive weeks.

This is the longest increase since September—October 2023, when Chinese utilities and traders stocked up on raw materials ahead of the Golden Week holidays and to meet the need to replenish stocks for the winter period.

The price increase came after falling steadily for most of this year, remaining in a certain range for most of 2024, with small fluctuations in response to sporadic purchases from China and uneven demand in South and Southeast Asia.

The recent increase was driven by a sharp increase in purchases in China. Tighter safety controls at domestic mines have led to higher coal prices in the country and a comparative reduction in the cost of imports shipped by sea. The summer heat wave in China has further increased coal consumption, which has led to limited availability in the shipping market.

"In July and early August, Chinese utilities had to rely more heavily on imports as domestic spot prices rose sharply," said a Singaporean trader. "It really gave the Indonesian and Australian suppliers a price advantage." The latest data from the General Administration of Customs of China showed that imports of coal and lignite to China grew for 2 months in a row, by 7.8% mom in July to 35.61 million metric tons, and then continued to grow to 42.74 million tons in August.

The increase occurred against the background of the fact that China's crude coal production in July amounted to 380.99 million tons, which is 3.8% less than in the previous year, and is the lowest since April 2024.S&P Global data shows that Indonesia was the largest supplier of coal to China during the year, followed by Australia and Russia.

The growth stopped in the week ending August 22, when prices began to decline again. Domestic coal prices in China have stabilized