International rating agency Fitch Ratings announced that it expects a moderate recovery in the global steel market in 2026, maintaining a neutral outlook for the sector. In Fitch's view, the decline in steel consumption in China will be broadly offset by a recovery in demand in other regions.

Supporting factors include easing monetary policy, continued infrastructure investment and a gradual recovery in construction activity. However, Fitch cautioned that the pace of recovery remains subject to risks from geopolitical uncertainty, weak demand in certain manufacturing segments and ongoing global trade tensions.

China: Production and exports expected to decline

In China, Fitch forecasts a decline in steel production of about 4.5 percent in As a result, Chinese steel exports are expected to fall from about 118 million tons in 2025 to 109 million tons in 2026, according to Fitch's Global Steel Outlook 2026. Despite lower production and exports, profitability for Chinese steel companies has improved in 2025 and is expected to continue to strengthen in 2026, supported by rising efficiency and easing cost pressures.

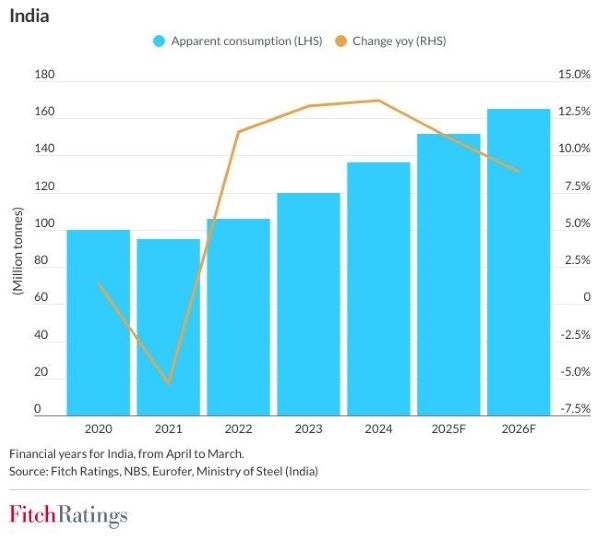

India will remain a key driver of growth

India is expected to remain one of the major growth engines of the global steel industry. Fitch noted that momentum will continue to be supported by robust government spending and policy measures supporting national infrastructure programs, urban housing development and industrial corridors.

Recent GST adjustments are also expected to strengthen demand from key end-use sectors, helping to partially offset the negative impact of international tariffs. However, Fitch identifies rising steel imports as the main risk to the profitability of domestic producers.

Europe: import controls and CBAM to support profitability

In Europe, Fitch expects tighter import controls and the gradual introduction of carbon tariffs on imports to support steel companies' profitability, while increased